Organising the right corporate structure requires understanding the various options available. We cover the most popular corporate structures employed in startups.

From the outset of the startup journey it’s important to establish your foundations correctly to avoid delays and uneccessary legal/accounting fees later on.

Some of the structures you’ll come across appear quite similar but really carry a world of difference. We cover the main ones here.

Discretionary Trust

Discretionary trusts are a popular tool amongst founders for a number of reasons most notably their asset protection & income distribution charactertistics.

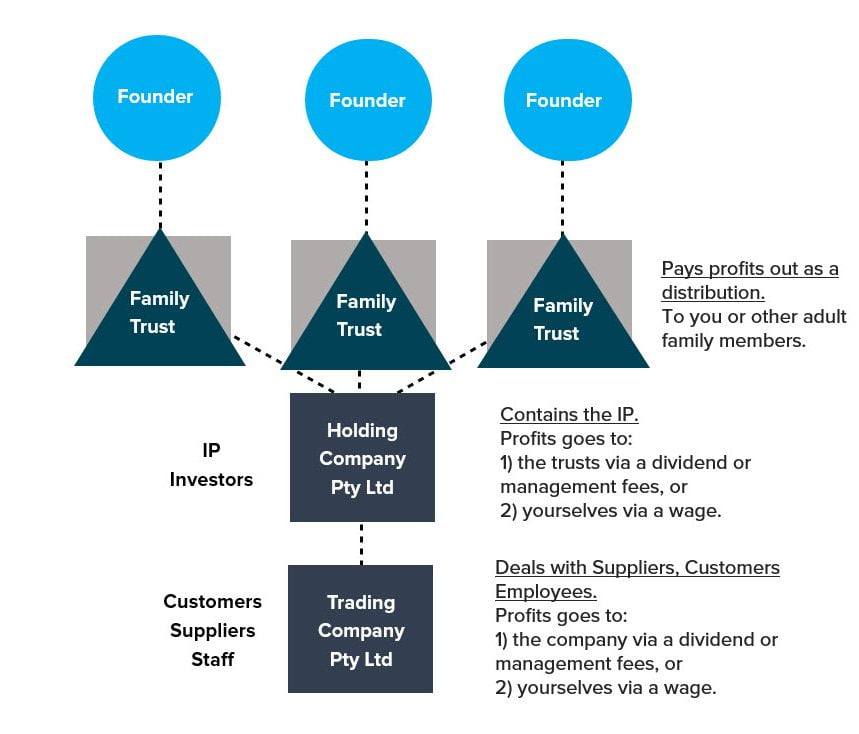

Whilst not a separate legal entity in its own right, the discretionary trust (often designated as a family trust) allows a trustee to control the flow of profits made by the trust to designated beneficiaries. The beneficiaries of these ‘distributions’ are often the directors, their associated entities and immediate family members.

Corporate Trustee

The trustee of a trust plays an important role in a trust and is often responsible for directing main activities of the trust.

Whilst trusts with individual trustees are certainly possible, the intergenerational nature of employing a company for this purpose means it is the popular entity for acting as a trustee.

A corporate trustee, also known as a trustee company, have most of the characteristics of a usual company except their activity for accounting and tax purposes is largely dormant.

When registering a TFN or ABN for a trust, the name will often feature “Trustee for ##### trust” otherwise the only identication relating to the trustee company itself will just be the ACN.

The directors and shareholders for the corporate trustee are generally the same persons involved in the main business, although their partners might be a shareholder as well.

Holding Company

The holding company is usually responsible for holding the main IP of the company along with having the biggest cap table owing to outside investors and founder shareholdings.

The trust above owns shares in the holding company, giving rise to the usual benefits of share ownership being dividends and (usually) voting rights.

Trading Company

The trading company is usually responsible for managing the public face of the company – trading with customers, managing suppliers and hiring staff. By segregating the main activity from the IP, groups are protecting themselves should an unscruplous operator try to sue the company.

Trading companies are usually wholly owned by the parent company and known as subsidiary companies. A different subsidiary might be setup for every country the group decides to hire staff in to manage local payroll & tax considerations more effectively.

The holding company holds shares in the trading company.

The Golden Standard for Group Structures

Here’s a diagram that represents the golden standard for corporate structures.

This particular structure segregates the various elements into different entities, minimising risk should any of the particular elements get compromised.

It also allows for an efficient way for investors and other key business partners to get directly involved in equity for whole group (as opposed to piecemeal sections).

As the business expands, further subsidiaries can be added on per territory.

If you need support with building your corporate structure, please reach out to your Fullstack advisor.

Was this article helpful?

Related Posts

- Corporate Structure: Should You Choose a Trust or a Company?

Business structure is important — should you operate through a trust or a company? In…

- How to Incorporate a Company in Australia

Incorporating a company requires careful planning. This article provides a step-by-step guide on how to…

- Company Directors: Dealing with Payments

There are many options to consider when paying a company director. Are you paying your…

- Crypto Trader vs Crypto Investor

Working out whether you are a crypto trader or investor at tax time can be…