When establishing your business structure, its ideal to feature a family trust before you progress operations in a big way. We’ll cover some of the main benefits & considerations below.

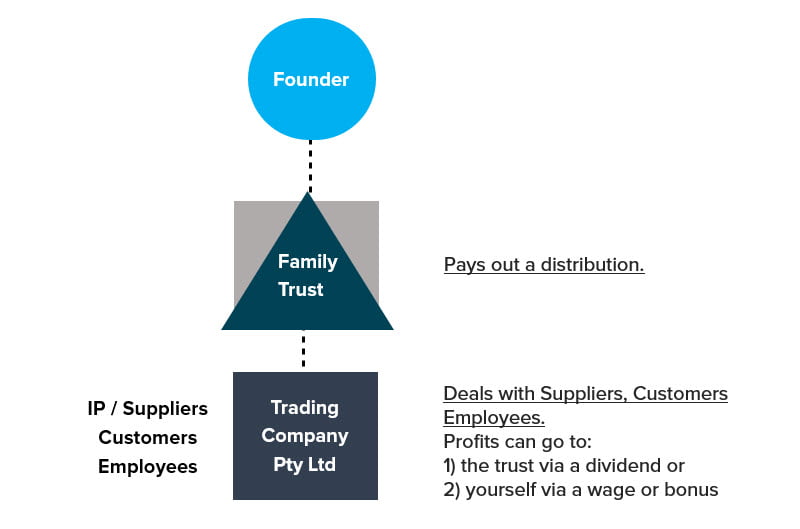

Family trusts feature in a lot of corporate setups to help benefit the founder or investor’s personal situation long-term. A popular setup is featured below.

Features of a Family Trust in your Business Structure

High level, the use of this structure (with a family trust and a corporate trustee) is very popular amongst sophisticated entrepreneurs and investors for the segregation of business risk from your personal assets & investments. This is in addition to the income distribution opportunities in the future.

This proposed structure contains many benefits as outlined below:

– Better asset protection – Should the trading companies be sued by an outside party (suppliers or employees) then it is much more likely that your personal assets & investments would be left out of the equation. The exception here is where directors are penalised for unpaid super or PAYG or trading whilst insolvent. The trust may also insert a layer of protection in that your shares in the holding company are not held by an individual and as such if the individual is sued, the shares of the business should not immediately form part of the asset pool available for claim. (Note personal legal advice is always recommended on this matter);

– Better income distribution prospects – As a popular tax effective strategy there is the potential to distribute taxable income from the trust across multiple beneficiaries once the business is profitable. Through an extensive tax planning annual process, we would look to distribute any income of the trust across your family (where appropriate) so as to reduce the overall marginal tax rate;

– Capital Gains Discount – A capital gains tax discount of 50% is available to the extent that the shares are held for more than twelve (12) months – this becomes relevant when your shares are sold, and this capital gain may be distributed amongst multiple beneficiaries;

– Continuity – The life of a Trust is 80 years. A corporate trustee, however, provides for continuity in that any change in directorship allows for the trust to continue (as opposed to the share portfolio entering the estate environment upon death);

The disadvantages of this structure are that losses (be it from investments or business) arising within the company or trust would not be able to be transferred back to you personally and would be carried forward until an income is made. Providing the businesses are based around professional services this is unlikely to occur.

What if I have already setup my company?

It is very common amongst new entrepreneurs to first own shares in a company directly, when seek to include a family trust once the business is showing some merit.

Whilst this a represents a logical progression of investment into a business which is progressively showing merit, the reality is that there is additional considerations around the transfer of shares held personally to the family trust.

The main consideration is a Capital Gains Tax event that occurs on the “disposal of shares” in the company by the founder when transferring to the trust. The additional taxable income attributable to the founder is the market value of the shares upon transfer less the original amount paid for the shares which is usually a nominal amount. This can be reduced by a further 50% should the individual shareholder have held the shares by more than 12 months.

It is then preferable to have the market value closer to nil when the transfer is made. Factors which can assist here might include:

- the business is not yet break-even

- no 3rd party investment has yet been made

- no significant IP has yet been developed

Should the business have acheived one or more of the above it is advisable that a 3rd party valuation of the company be made to help determine an appropriate market value for the business to use for your CGT calculation. A dedicated business valuer (not your existing accountant) is best placed to assist here, since their independence will have more clout in the instance of an ATO review.

What about the ongoing considerations for the Family Trust?

For many founders, the family trust is quite dormant from year to year. If no activity has transpired then only the ASIC annual fee (for the corporate trustee) and a Return Not Necessary notification is required for the ATO from year to year.

Once the business is profitable (or sold) then there is the added consideration of whether distributions are required. The business could pay a dividend to the trust in respect of its taxable profits (if not reinvested into the business) which would have to be distributed to the beneficiaries of the trust.

The major trigger for a distribution is of course when the business is sold in which case the resulting windfall of capital proceeds would be an excellent tax planning exercise with your accountant.

Key Takeaways

Including a family trust in your business structure can have a lot of benefits but it is important to organise it properly to reduce the exposure to CGT upon restructure.

Should you have any queries or require personal advice for your business structure, please reach out.

Was this article helpful?

Related Posts

- Corporate Structures: Choosing the Right One

When establishing your business, what corporate structure you choose is just important as making your…

- Small Business Tax Rate for 2020 & 2021

In this article we look at tax rates for small business in 2020 and 2021.Small…

- Good to Great: How to Take Your Business to Greater Heights

Building a 'great business' takes strategic vision & focus. We cover Jim Collin's book and…

- 8 Must-Read Startup Books for Founders

Effective startup founders leverage the experience of others. If you’re planning on launching a startup,…

- Corporate Structure: Should You Choose a Trust or a Company?

Business structure is important — should you operate through a trust or a company? In…

- Discretionary Trust Setup in 5 Easy Steps

Setting up a discretionary trust may seem like a headache — but can be achieved…

- Small Business Grant

Been hiring recently? You’ll be pleased to note that the NSW government is keen to…

- Investing: Cryptocurrency and Family Trusts

For many cryptocurrency investors, setting up a family trust can be a highly effective tax…