Accounting & Tax

Accounting & tax services to help you grow your business & reach your potential.

Accounting & tax services to help you grow your business & reach your potential.

Enjoy the benefits our processes & best practice technology have for your business.

Utilise tax concessions where available to your business - particularly for startup or SMEs businesses.

Lodge your tax obligations (tax returns, BAS and more) on time and keep your stakeholders onside.

Fullstack Advisory help brings the tax into perspective and helps outline in terms the financial outcomes for your business.

Our seasoned tax expertise looks out for your long-term interests and helps you evaluate the best course to tread.

Our professional team of accountants & business advisors help you navigate the various challenges to lift business performance and create successful outcomes.

Our technical tax staff can make sure all tax offsets & allowances been considered and help you explore the different avenues for optimising your tax position within the ATO’s guidelines.

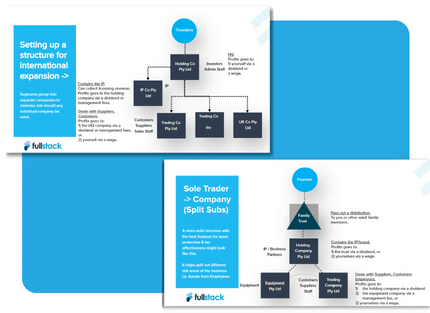

We review your business structure strategically across our 3-way lens of tax, cash flow & commercial and employ restructuring techniques to obtain the best outcome.

Many different concessions are available to aid startups and their cash flow. With our assistance, we’ll help make sure you don’t miss out and that you take advantage of the relevant ones.

Plan your overseas expansion with our team and get the benefit of our international network and experience with tax treaties, restructures and overseas tax jursidictions (in conjunction with overseas tax partners).

When selling or transferring shares in your company

or property we maximise the use of CGT concessions

available. Get extra confidence from our projections &

detailed analysis with reference to legislation and case law.

Secure the generous ESIC tax incentives for investors

via our private ruling service. We can also provide

tailored advisory to management & investor materials.

Motivate key staff with an Employee Share Option

Plan that brings them along for the journey. Utilise key

tax concessions to reduce the cash impacts for staff.

As one of longest standing accounting firms to specialise in the tech & online industry, we have deep expertise in the unique arena that high growth, innovative businesses play in.

Our team consists of tech seasoned professionals helping you get VIP treatment every step of the way.

We are passionate in seeing your business & financial interests grow and prioritise adding value for your situation.

![]()

Top-talented team that really are "full stack" in covering bookkeeping, tax, employee management, R&D, etc. The team are very helpful and friendly to work with.

![]()

They're providing very good advice. Fullstack has been there from almost day one & we vouch for Fullstack for both for the great service, but also for the quality of the expertise.

![]()

Recommend Fullstack to other like-minded founders because we’ve found them to be the most like-minded and entrepreneurial accountancy and advisory service that we've come across.

Discover how Fullstack can help scale your business whilst keeping tax compliance.

Book in a time to discuss your accounting & tax requirements today.

Our staff are seasoned and effective, allowing a 1-2 day response on most queries and reasonable turnaround on more extended jobs. We seek to schedule in work with you if not urgent.

You are welcome to book a time using the link above to discuss or via the contact us page.

We will never share your details with any third-party.

Suite 63, 388 George St, Sydney NSW 2000

120 Spencer St Melbourne VIC 3000

310 Edward St Brisbane QLD 4000

1300 887 627

|