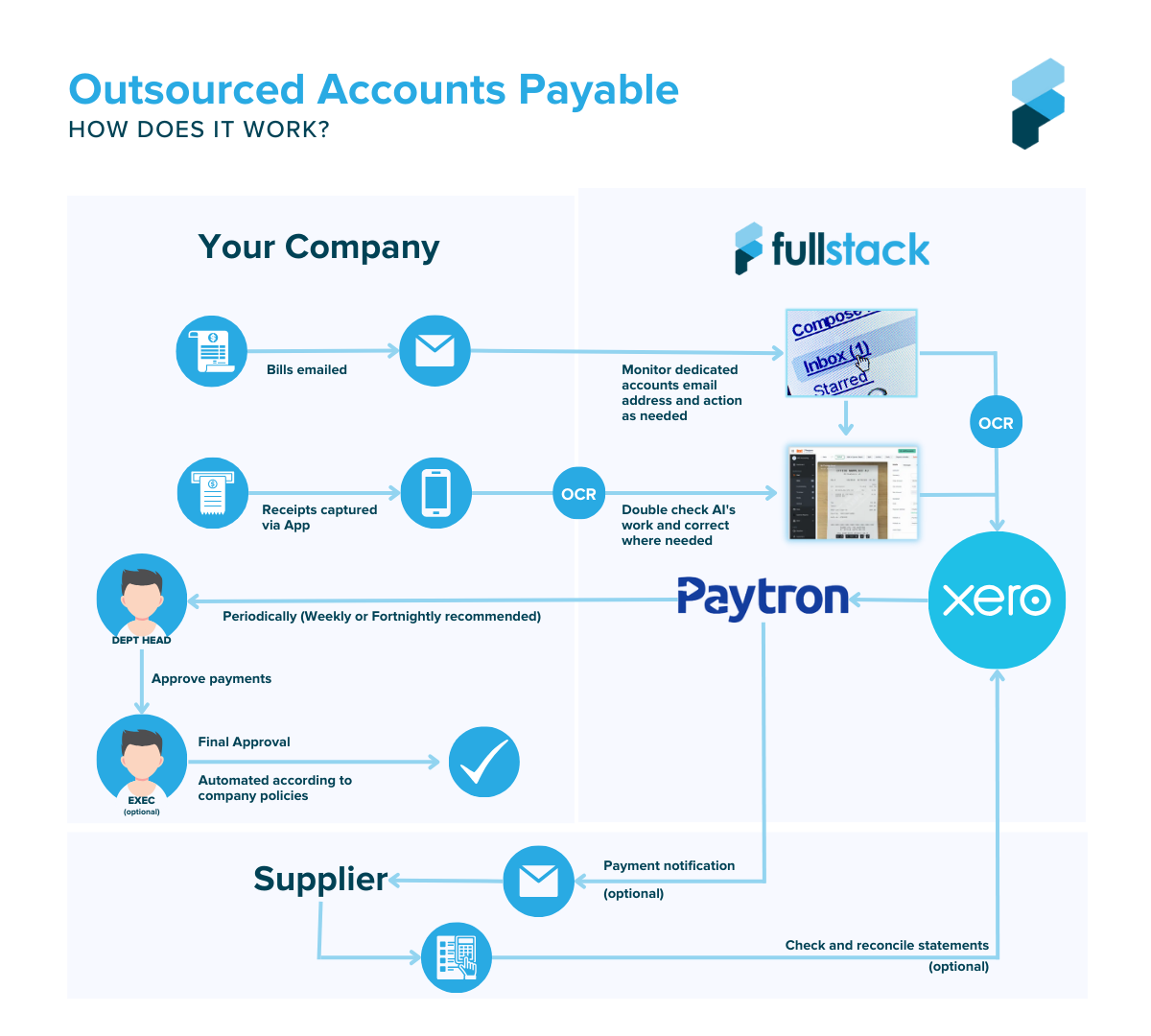

Fullstack Advisory’s mission is to serve startups and scaleups with innovative financial advisory, modelling, and reporting to ensure they are set up with the best chance of success in the marketplace. We offer a comprehensive range of services

Best Accounting Practices – we partner with your startup from day one, ensuring your financial processes and procedures adhere to best practices in terms of tax, record keeping, financial reporting, and due diligence.

Virtual CFO – Fullstack are leaders in providing an end-to-end solution for financial control and reporting expertise. Your VCFO oversees high-quality finance department as well as additional strategic support for capitalising on future opportunities.

Complete funding resource – As leaders in connecting founders with government tax incentives and grants, we can help your business with preparing and lodging grant applications so you can take advantage of every opportunity including the Export Marketing Development Grant & R&D finance.

Executive Advisory – We provide C-level and tactical support for your new startup that extends to all parts of the business including HR, communications, strategic planning, operations management, and decision support.

Financial Reporting – Our team implements the latest technology for financial reporting and business intelligence, ensuring you gain insights with reliable data that leads to better and faster decision making.

Technology Implementation – Fullstack advises and implements a full accounting and financial technology stack to enable your business to take advantage of enhanced reporting and streamlined processes from day one.

Due Diligence – Our GAAP accounting and other financial metrics monitoring means your startup has all its due diligence in order whether you’re approached for a merger or acquisition or looking to be acquired later down the track.

Fullstack is a leader in delivering tech-powered accounting and financial advisory services in Australia and have assisted tons of innovative businesses and startups to date.

We encourage readers to draw upon the detailed insights provided in this guide to get to the next level. If you would like help with your startup accounting, please contact us.