Financial Modelling

The essential tool for raising capital and forecasting

business performance.

business performance.

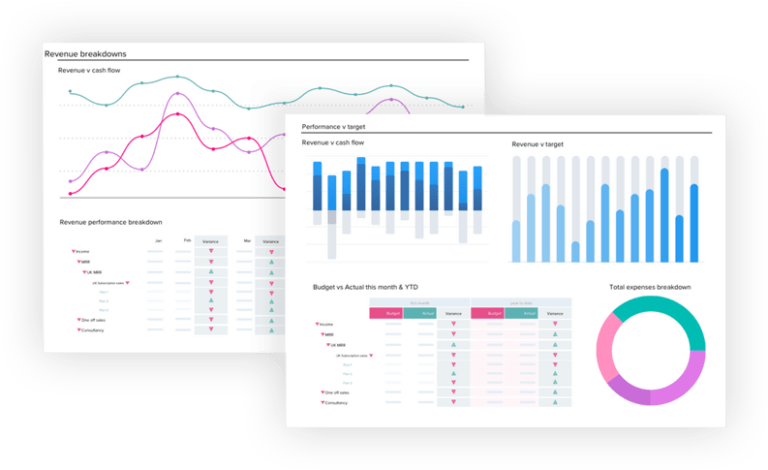

Build in graphs and identify the key metrics that will determine your venture’s success. Show your financial storyline to potential investors with more clarity.

Trial ‘what if’ outcomes like different pricing plans or headcount and gauge the impact to cash flow & profitability.

A Financial Model can be used to provide extra confidence to investors or add to the case for a valuation for a potential transaction.

We have a proven procedure for developing robust financial models for your business.

Financial modelling that accommodates multiple offerings and business models ready to scale.

Illustrate your financial plans in detail to show how investments today deliver ROI in the future.

No heavy finance expertise required – we workshop the financial model with you.

Set up the perfect platform for VCFO advisory services moving forward.

STANDARD FINANCIAL MODEL

FROM

$2,500PREMIUM FINANCIAL MODEL

FROM

$4,000All services quoted ex. GST

Raise your round, and enter the dataroom in confidence with our essential capital raising support services.

The financial model gave us clarity around the various drivers that make up our business as well as revealing areas of the business that need to be worked on.

One of the directors at Macquarie Capital, after looking at our financial model mentioned that it was one of the best ones he had seen so far in his career.

Highly recommend Fullstack’s financial modelling expertise, knowing that it will support you in the journey to growing your business.”

Davyn De Bruyn – MD, Thread Harvest

Includes:

Delivery:

Includes:

Delivery:

Includes:

Delivery:

Includes:

Delivery:

Includes:

Delivery:

Includes:

Delivery:

Ask Fullstack for a ‘demo’ on a financial model that illustrates your vision to stakeholders in financial terms.

We will never share your details with any third-party.

Suite 63, 388 George St, Sydney NSW 2000

120 Spencer St Melbourne VIC 3000

310 Edward St Brisbane QLD 4000

1300 887 627

|

We will never share your details with any third-party.

Suite 63, 388 George St, Sydney NSW 2000

120 Spencer St Melbourne VIC 3000

310 Edward St Brisbane QLD 4000

1300 887 627

|