Thinking of using Xero as your accounting software? We will run over the basic functions of the program you will need to know to get started.

Xero has become the favourite accounting software of the startup industry. Its cloud-based platform and robust integrations make it accessible to businesses in all industries from SaaS to e-commerce and everything between. 95% of our clients are on Xero and this remains our accounting system of choice at Fullstack.

We will run over the basic functions of the program you will need to know to get started.

Setup the Xero accounting platform

Once you have subscribed and setup your basic details, you will need to setup your Chart of Accounts. You can use Xero’s standard Chart of Accounts template or work with your Fullstack Advisor to tailor this to your specific needs.

Choose Users to access the Xero file

Next you will want to invite users to the file who will need to be actively viewing or working on the file, specifying the access each will have.

Add customer & supplier lists

If your business has been running previously you can add existing customer and supplier lists you may have. Use the template file to upload in batches.

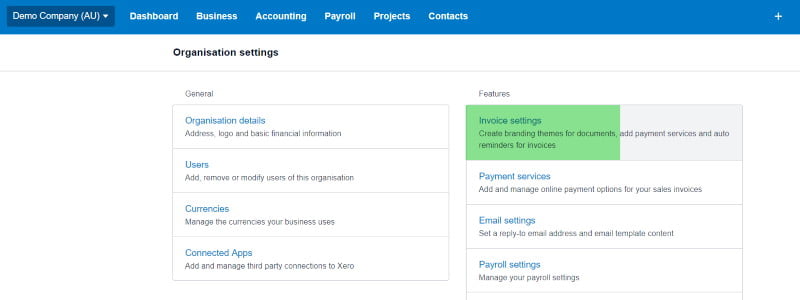

When setting up your payment settings, bear in mind Xero’s payment services integrate well with PayPal and Stripe.

Connecting bank feeds and reconciling transactions

Connecting Xero to your bank account via Xero Bank Feeds is straightforward, but you will need your bank details on hand as this will take you directly to the online banking portal to integrate the two.

Importing bank statements can save time if the bank feed integration has issues. Just go to Manage Account > Import a Statement, then upload the CSV file from the bank for the period required.

Note that Xero Bank Feed only works on a progressive basis, so any prior transactions will have to be upload in this manner.

Reconciling transactions in Xero

Once Xero has been uploaded with transactions, it’s time to allocate them in your Chart of Accounts otherwise known as reconciling.

- Xero allow us a few different ways to achieve this:

- Match – if you have entered in an invoice or bill previously, the system will recognise and match the transactions in the bank account.

- Create – if Xero has no prior details about a new transaction, allocate manually using this option.

- Transfer – to allocate interbank transfers between company bank accounts.

- Discuss – for any strange transactions, you can leave a note for another person from the organisation or your advisor from Fullstack.

Xero Tip – Set up Bank Feeds

Using bank rules will be your best friend to get much of your transactions reconciled automatically. This is a very useful tool for allocating recurring or standardised transactions that are for the same account every time. For example, BP Petrol is likely to be for Fuel. You can create the rules based on the amount, name or date.

Adding Bills in Xero

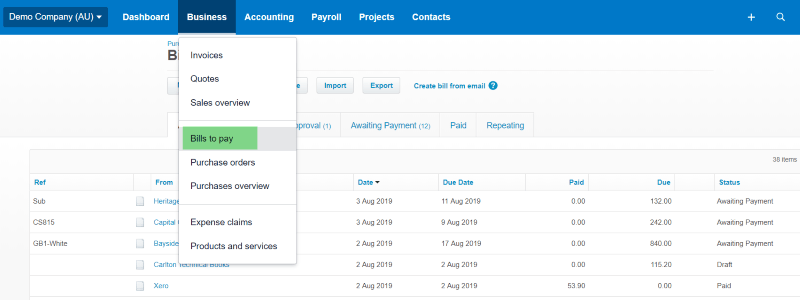

You can manually add bills by generating these under Business > Bills to Pay > New Bill. You can then match them to transaction from your bank feed when reconciling once the bill is paid.

Use the purchases overview menu to oversee all your bills & accounts payable where you can see those awaiting payment, drafts and any overdue.

Xero Tip – Email your bills directly to Xero

Email your bills directly to Xero and save yourself time getting your accounts in order each month. Just go to your company name > Files – and email pdfs of your bills to the unique email address shown. Add the bill when reconciling by selecting add details in the reconciling screen and attach the file to the transaction.

Xero Invoicing

To send customised invoices, be sure to setup your invoice settings in a friendly format to your clients.

You can generate quotes with your company logo and style easily. Once these are drafted each can be sent to the clients for approval, and once approved are transferred automatically to invoices.

If no quote is necessary creating new invoices is very straightforward. The minimum details needed will be clients name, quantity, unit price, due date and account. For any recurring clients just select the recurring invoice tab.

Control debtors by using the sales overview tab. Select Send Statements to chase those that are still awaiting payment. You can set reminders up to send these weekly, fortnightly or monthly if necessary.

Managing Payroll in Xero

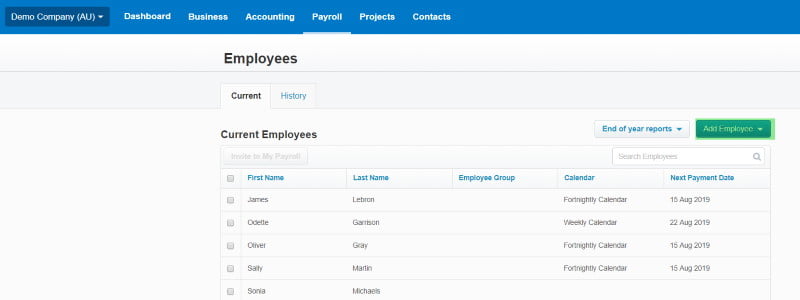

Adding Employees

Add your employee’s details on the platform by selecting Employees > Add Employee.

This process is much easier with an onboarding spreadsheet which your Fullstack Advisor can give to you.

Once their details are organised, add them to the employee portal so they can view their payslips, next pay date and total salary.

Running Payroll

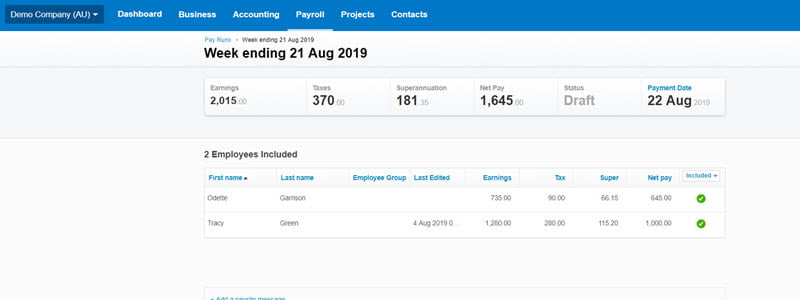

Start with selecting Pay Runs > Add Pay Run. The pay cycle will be determined by the payment frequency determined for each employee, so it is much easier to organise all employees on the same pay cycle whether that is weekly, fortnightly or monthly.

- Here are the basic steps to organise a pay run:

- Select the pay period. This will be determined by the payroll calendar for each employee (i.e. weekly, fortnightly or monthly).

- Review the calculations. It will automatically calculate each employee pay based on their hourly rate and hours worked per week. If they are consistent full-time staff, this will not change however if not, this may require some adjustments.

- Post and Pay. Post the pay run and download the ABA file. Once the ABA file is uploaded to the bank account the transaction will flow back to Xero and easily reconcile be reconciled.

- Send to staff. Use Xero to email out the payslips within the platform.

Popular Xero Add-ons and other features

Xero provides a solid foundation for its third party application providers. It has an open API which makes it an attractive partner for developers, some of which are our clients!

- The most popular apps our clients are using in Xero are:

- Paypal – link your Paypal account like a bank feed

- Stripe – offer your customers an easier payment method via credit card

- Hubdoc – reduce time inputting details of bills through OCR technology

- Expensify – easy expense reporting for reimbursements

- Chaser – automate collecting your debtors

- Waddle – free up cash through invoice financing.

Xero is one of the most user-friendly accounting platforms around and clients love the way it supports the financial insights about their business. If you need training on best practice or even regular bookkeeping, please speak to the Xero Accountants at Fullstack Advisory.

Was this article helpful?

Related Posts

- Processing Xero Superannuation

Xero Superannuation is a timesaving feature within Xero which allows the business to pay their employees'…

- What Accounting Software Should I Use?

Confused on which cloud accounting software to use for your business? We review and compare…

- Expense Reimbursement

Find reviews, comparisons and pricing of popular software you can choose from to make employee…

- Cloud Accounting - Which Accounting Platform

We've done the hard yards in trialing out the cloud accounting solutions so you don’t…