Find out about Xero superannuation – a cool feature of Xero which allows the business to pay superannuation of their employees within the Xero accounting software.

What is Xero Superannuation?

Xero Superannuation is a feature within Xero which allows the business to pay their employees’ super without leaving the platform. It also means business owners don’t have to worry about creating a super clearing house account – a major timesaver!

How do I get started with Xero Superannuation?

To get started processing the superannuation payment in Xero, you’ll need to first add a regulated super fund or SMSF and enter the super membership details of your employees under the employee’s file.

- Secondly, you’ll have to make sure to add all employee details to meet the data standards of Super Stream:

- Under the Details tab, add an employee’s personal and contact details. These include Last Name, Email, Date of Birth, Gender, Address, Suburb, State and Postcode.

- Under the Taxes tab, add an employee’s Tax File Number (TFN) or note the TFN Exemption.

Once you have followed the above steps, you can now proceed to create batch payments of super.

Creating a New Batch Payment

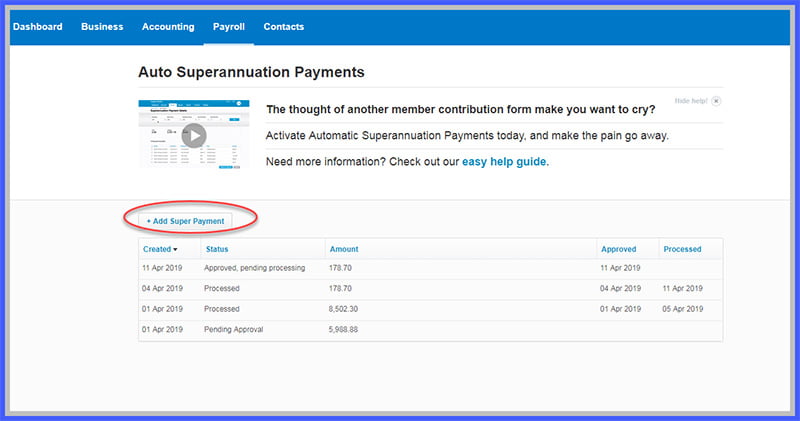

- Under the Payroll tab, choose Superannuation

- Click on the + Add Super Payment

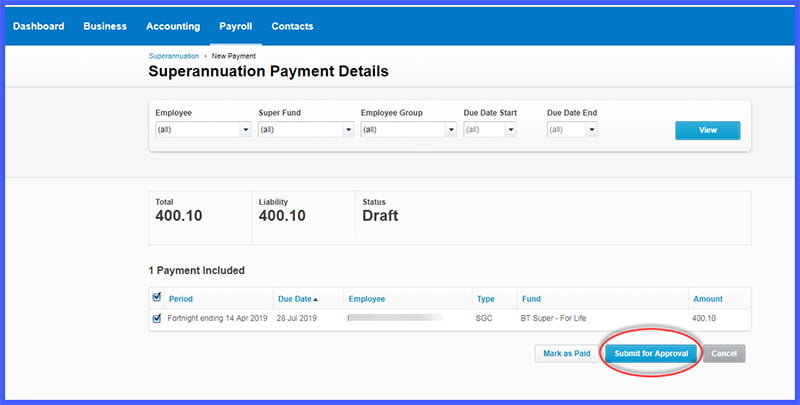

- In the payment details page, select all the super payments that need to be paid from the list of posted pay runs.

Note: You can filter payments using employee groups, super fund or by employee name. See below:

- Once the payments are selected to include in your batch, click “Submit for Approval”

Next step will be to authorise the payment batch you have just created.

The batch will be appearing in the superannuation home screen as ‘Pending Approval’

Nominated authoriser of super payments will receive a text from Xero with the authorisation code to authorise the batch, the code will be valid for 24 hours. An email will be sent to let you know about the SMS text.

Authorising a Batch Payment of Super

If you’ve received an SMS with a code to approve a super payment batch:

- In the Payroll menu, select Superannuation.

- ‘Pending Approval’ batch should be selected.

- Review all the payments included in the batch you have created.

- Delete the payment if you notice any mistake or if something is amiss

- Proceed to Approve & Submit if all information seems to be correct, enter the authorisation code you received in the SMS to complete the process.

The payment batch will now move on to the next step and will be shown as ‘Approved, pending processing’. The payment will then be direct debited from your bank account and appear on your bank statement as ‘SuperChoice P-L’.

It can take up to five business days for your payment batch to reach your employees super funds. Once the super funds receive the contributions, the status will update to ‘Processed’.

A common issue: When trying to create an Auto Super batch, the “Something has gone wrong” error message keeping appearing.

Solution: The mobile number listed for the Auto Super Authoriser is likely to be invalid or incorrect. Review and update the number via the Automatic Superannuation tab in Payroll settings.

If you need assistance around implementing this for your Xero Accounting file reach out to our bookkeeping crew to get you started on the right path.

Was this article helpful?

Related Posts

- What Accounting Software Should I Use?

Confused on which cloud accounting software to use for your business? We review and compare…

- Expense Reimbursement

Find reviews, comparisons and pricing of popular software you can choose from to make employee…

- Cloud Accounting - Which Accounting Platform

We've done the hard yards in trialing out the cloud accounting solutions so you don’t…

- Startup Accounting Policies

Startups often have unique business models which can raise difficult questions about the most appropriate…