Single Touch Payroll is the ATO’s new initiative to streamline reporting on wages and super. Here is a checklist to prepare for the changes.

What is Single Touch Payroll?

Single Touch Payroll is the tax office’s new initiative to streamline reporting on wages and super.

Most mainstream accounting software providers (such as Xero) have already done the leg work in integrating STP with their payroll functions. Instead of processing payroll and separately declaring this again in your monthly or quarterly instalment statements, the information is sent directly to the tax office after each pay cycle.

Employers will also not be required to provide a PAYG payment summary at year end. This removes the middleman so to speak and should result in less time spent on reporting wages.

What’s the benefits of Single Touch Payroll?

For employees the major benefit is transparency. They will be able to check their wages and super are being paid in full and on time through their MyGov accounts, rather than checking payslips and super accounts.

From 1 July 2019, most businesses will need to report through Single Touch Payroll, although small employers with 4 or less employees will have additional options. The tax office has also provided a handy list of low-cost payroll providers for the latter companies, which includes cheaper plans by Xero & MYOB.

How to best prepare for Single Touch Payroll?

- Here is a checklist to prepare for the changes:

- Check you are using STP compliant accounting software (such as Xero or Quickbooks)

- Enable STP by connecting the accounting platform with the ATO portal

- Confirm the person responsible for payroll reporting and troubleshooting any issues.

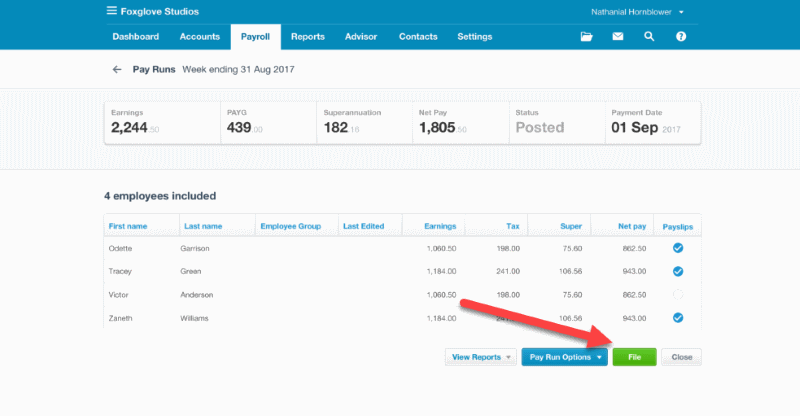

- File your payruns for STP moving forwards.

If you are still unsure or need more time you can apply for more time with the ATO to get ready. During FY2019, the ATO will not be issuing late fees in relation to this new system.

If you have any more questions around implementing Single Touch Payroll for your business please reach out to our Xero Accountants today.

Was this article helpful?

Related Posts

- Getting started with customer feedback & the NPS

Is there a better way to build customer feedback into your process? Onboarding feedback helps…

- Equity Crowdfunding in Australia

Crowdfunding is making some big waves in recent times - we cover why many founders…

- Triple Bottom Line Reporting

There is a global trend towards greater corporate responsibility and accountability. Triple Bottom Line reporting…

- Getting started with Xero Accounting

Thinking of using Xero as your accounting software? We will run over the basic functions…