Valuing a company is challenging, with founders seeking high valuations based on optimistic future revenues and investors favouring conservative approaches tied to current revenues. The final valuation depends on consensus between founders and investors. The Berkus Method stands out as a highly effective approach for valuing pre-revenue startups.

Simplified valuation: Berkus Method

The Berkus Valuation Method offers a direct approach to assessing the pre-revenue value of a company. Providing entrepreneurs and early-stage investors with a straightforward tool, this method evaluates a pre-revenue startup by emphasising risk factors rather than relying on financial projections.

The Berkus Method provides aspiring entrepreneurs and early-stage investors with a clear framework, enabling them to prioritise risk factors over final projections when valuing a pre-revenue startup. Nonetheless, it’s essential to note that this method doesn’t replace the startup’s obligation to carry out thorough due diligence.

The Berkus Method determines the value of a company prior to its first revenue, originating in the 1990s through the work of Dave Berkus, a renowned angel investor and venture capitalist in the United States. Let’s delve deeper into the details of the Berkus method valuation.

Breakdown of Berkus Method: Valuing early-stage startups based on key factors

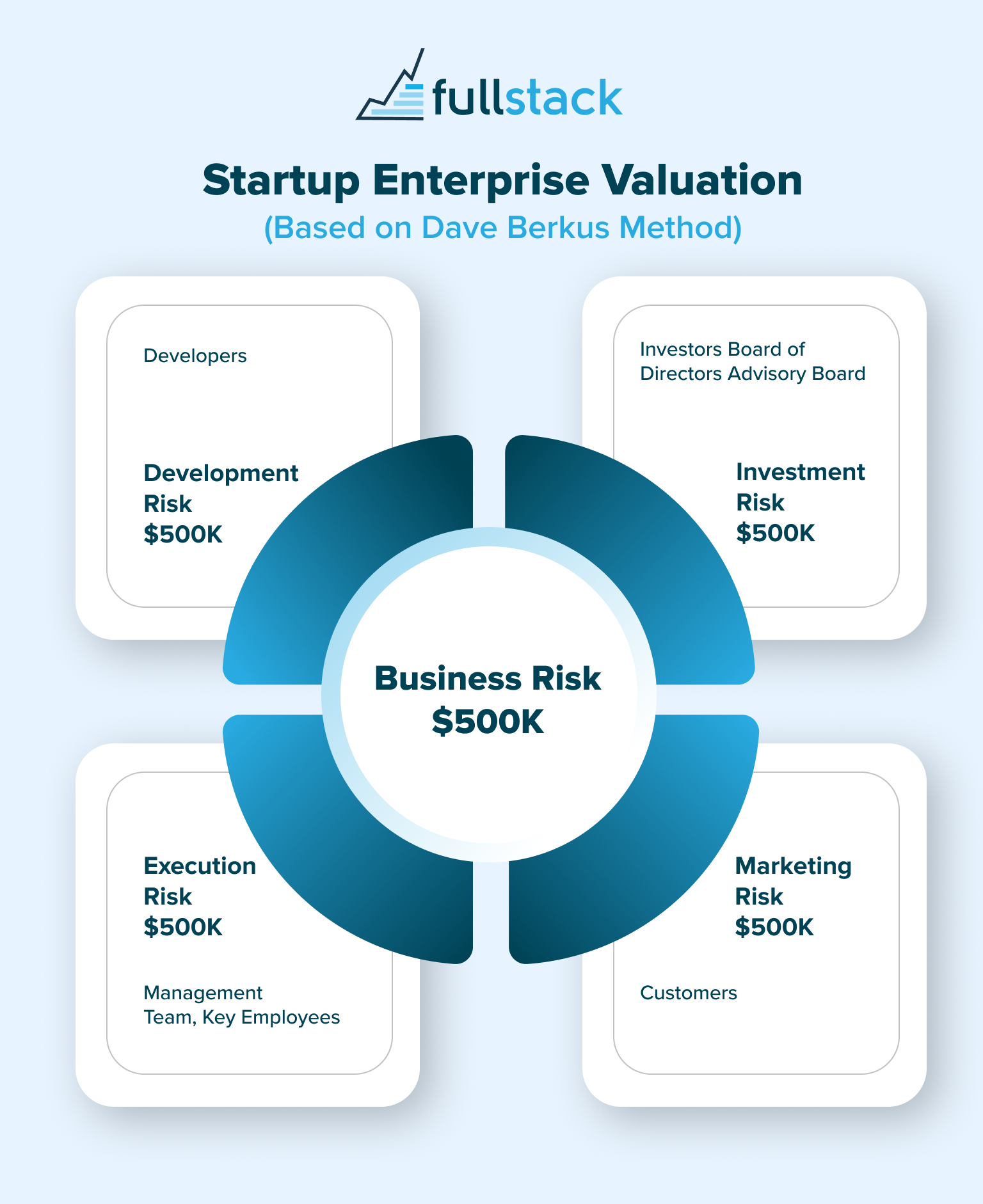

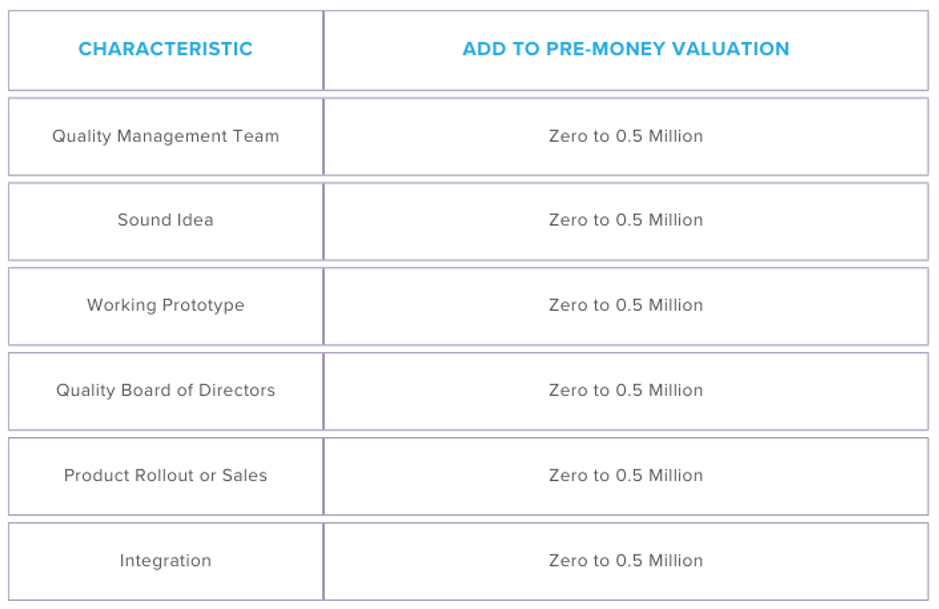

The Berkus Valuation Method is an early-stage approach designed to establish a foundation independent of founders’ financial forecasts. It assesses five pivotal aspects of a startup, assigning values ranging from zero to $500,000 to each area:

- Sound Idea: E.g., $0 – $500,000 for an exciting business idea.

- Quality Management Team: E.g., $500,000 – $1,000,000 for an excellent management team.

- Prototype: E.g., $1,000,000 – $1,500,000 for a solid product or prototype attracting customers.

- Strategic Relationships: E.g., $1,500,000 – $2,000,000 for powerful alliances, partners, or a growing customer base.

- Product Rollout or Sales: E.g., $2,000,000 – $2,500,000 for signs of revenue growth and a pathway to profitability.

The cumulative value determines the pre-money valuation for the startup. The original Berkus method featured five areas with a maximum of $500k, resulting in a theoretical maximum pre-money valuation of $2.5 million.

Therefore, a crucial adjustment to the Berkus Method involves adapting the theoretical maximum to enhance flexibility in both the designated areas and allocated amounts. This adjustment incorporates the geographical region as the area and the average valuation for a specific startup as the amount. For example, if the average valuation for a given startup is $6 million, each of the five areas would receive up to 20% of $6M, resulting in $1.2 million each instead of the original $500k. The criteria are outlined as follows:

In this context, the total sum of the components equates to the baseline pre-money valuation, resulting in a potential pre-money valuation ranging from $0 to $2.5 million based on the chosen amounts. If an entrepreneur opts for a stand-alone valuation, it is recommended to possess a solid understanding of pre-money valuations within the early-stage startup landscape per industry. This is crucial since there are no quantitative factors or multiple performance metrics available for reference.

The Berkus Method is widely regarded as a valuable complement to the Venture Capital Method of pre-money valuation. This is attributed to the Venture Capital Method’s heavy reliance on industry quantitative data, whereas the Berkus method considers qualitative factors in addition to the mentioned criteria.

What makes the Berkus Method a preferred valuation choice for early-stage startups?

Many companies fall short of meeting their financial projections, and this poor track record underscores the unreliability of economic predictions for startup valuation purposes. Management often acknowledges that aggressive revenue growth may involve unrealistic profit margins. This discrepancy prompts banks to conduct sensitivity analyses to assess a company’s repayment capacity, while the Berkus method adopts a risk-centric approach to startup valuation.

The Berkus Valuation Method assigns a value to the business idea and four key success factors, each capped at $500,000. These critical value drivers identify risk areas that can significantly impact a company’s fate. The effective management of these principal risks is essential for a company’s success. As a company mitigates its key risks, its value increases, highlighting the close relationship between risk reduction and valuation enhancement. Berkus’ method is particularly suitable for very young, pre-revenue startups and may not be appropriate for valuing companies with recurring revenue streams.

Essential aspects to comprehend within the Berkus Method

Below are the crucial elements under the Berkus Method that require understanding:

- Sound Idea (basic value)

- Prototype (reducing technology risk)

- Quality Management Team (reducing execution risk)

- Strategic Relationships (reducing market risk)

- Product roll-out or Sales (reducing production risk)

Sound Idea: Every startup commences with an idea or course of action, originating from its founder. The merit of this idea lies in its potential to address unresolved problems or update existing business models within the target industry. A common pitfall during idea validation is excessive spending. It is imperative for a startup to conduct a comprehensive evaluation with an extended target audience, considering:

- Proprietary Nature: A business idea should be capable of protection through patents or copyrights, ensuring the potential for significant returns.

- Well-Defined Future Plan: Investors focus on the big picture when investing, making a well-planned trajectory for long-term startup viability essential.

- Scalability: A scalable business can expand with minimal incremental costs, a crucial factor for survival in a competitive market.

- Socio-political Relevance: The appeal of the startup idea to the general audience depends on the prevailing socio-political climate, emphasising the necessity of staying relevant.

- Validation: To mitigate risks during implementation, the idea must undergo thorough experimentation with a large audience.

Prototype: Within the Berkus Method’s startup valuation, the prototype stands as a pivotal parameter. It serves as a replicated version of the actual concept or product, allowing for the testing of its viability. The primary purpose of prototyping is to address identified flaws before committing significant resources such as energy, money, and time. Startups should recognise the critical importance of the prototype, as it not only validates the functionality of the product but also serves as a risk management tool, particularly in the technological domain. Various technology risks associated with IT products, such as breaches of confidential data, system breakdowns, cyber-attacks, and more, can significantly impact a business’s reputation.

Management Evaluation: When assessing a startup, a venture capitalist or angel investor typically begins by scrutinising the founder’s domain expertise and track record. If the business founder has established a commendable reputation within the startup’s domain, this factor holds greater weightage in the management’s valuation. This not only instils a sense of security concerning the management’s effectiveness but also underscores the significance of proficient leadership. In essence, the success of a team can be encapsulated in two words: good management. The higher the administration’s capabilities, the higher the resulting valuation.

Strategic Relationships: Business success is often hinged on relationships, and the efficacy of their establishment can significantly impact your business outcomes. These relationships are strategic collaborations involving two or more parties working together for mutual benefits. Startups frequently forge strategic relations with established entities to tap into their expertise and resources. This approach proves especially valuable when startups face incomplete production or distribution chains, utilising these relationships to facilitate a smoother rollout and functioning.

Product Rollout: The product rollout marks the final stage of the development process and serves as a critical determinant of a startup’s success or failure. The scope of the product rollout is contingent on the market size, whether it is initially introduced to a limited or global audience. This phase involves an internal analysis of the startup’s capacity to effectively market and sell its product, encompassing activities from pre-launch to post-launch. A meticulously planned rollout, guided by a product protocol tailored to benefit the target audience, is essential for success. The outcome of the rollout serves as an indicator for the future expansion prospects of the company.

Benefits of the Berkus Valuation approach

Key Advantages of the Berkus Valuation Method:

- Qualitative Focus: The Berkus Method relies solely on qualitative aspects, offering a traditional approach to valuing pre-revenue startups. It provides a preliminary estimate of valuation.

- Flexibility: The model can be easily tailored to specific circumstances, allowing users to modify it to better suit their needs.

- Corporate Governance and Risk Management: The method prompts users to consider crucial corporate governance and risk management aspects. This includes evaluating the company’s strengths and weaknesses, assessing the management team’s competencies, and addressing potential conflicts among founders.

- Quick and Straightforward: The Berkus Method offers founders and early-stage investors, including business angels, venture capital funds, and crowdfunding backers, a rapid and uncomplicated valuation approach.

Drawbacks of the Berkus Valuation approach

The primary limitations include:

- Simplicity as a Double-Edged Sword: The method’s simplicity is both its strength and weakness. Founders and investors must recognise that startup valuation using this method has inherent limitations.

- Conflicting Interests: In discussions about potential investment deals, founders and investors often have conflicting interests. Founders aim for higher valuations to maximise profit, while investors benefit from lower valuations.

- Speed vs. Understanding: Theoretically, a Berkus valuation can be completed within minutes. However, it’s crucial to comprehend the business risk profile, key risks, and risk mitigants of the company.

- Neglect of Financial Risk: The method overlooks a significant aspect for startups – financial risk. While the Berkus approach provides valuable insights, a comprehensive financial plan remains essential for businesses to assess their capital requirements and gain a deeper understanding of their dynamics.

Valuations can be a hefty investment, but fear not. With Fullstack’s startup valuation, you can secure an affordable assessment customised to your business needs.

Was this article helpful?

Related Posts

- Advisory Boards for Startups

As a startup you will often hear about the need for an Advisory Board, but…

- Applications For The RMF Plastics Technology Stream

The RMF Plastics Technology stream is currently accepting applications. Its primary objective is to provide…

- Using a Company for Crypto

Choosing to incorporate an Australian company for your crypto affairs has a wide array of…

- Crowdfunding

Crowdfunding is making some big waves in recent times - we cover why many founders…