The Australian Government has doubled the length of the JobKeeper payment scheme and changed the way eligibility works — here is what you need to know about JobKeeper 2.1

The Australian Government has announced JobKeeper updates. The changes to the JobKeeper Payment scheme will come into effect from the 14th of August, 2020. The updates to the scheme will alter the ways in which employees can qualify for the JobKeeper Payment and extend key JobKeeper dates.

The complex changes to the new JobKeeper 2.1 scheme can be confusing — here’s what you need to know about the new JobKeeper Payment Scheme and what it means for your business.

Jobkeeper Extended to March 2021, New Changes Implemented

The latest changes to the JobKeeper Payment scheme follow an announcement released by the Australian Government on July 21, 2021, extending the JobKeeper Payment Scheme for an additional six months beyond the original and date of 27 September 2020 to 28 March 2021.

- The period of the new extended JobKeeper Payment Scheme consists of 26 weeks, or 13 fortnights, which doubles the length of the original duration of the scheme. The new changes will come into effect from September 28, and include:

- A new two-tier payment rate that will be applied based on the average weekly work hours of an eligible worker during reference periods

- A reduction in fortnightly payment rates that will see the current $1,500 per-fortnight payment reduced on the 28th of September, and further reduced January 4 2021

- Changes to the decline in turnover test, which will now be retested on a quarterly basis, with assessments made based on actual GST turnover

An announcement published on August 7 by the Treasurer detailed a series of additional changes that would alter the way Australians are able to access the JobKeeper Payment Scheme during the extension period, driven primarily by the economic impact of the COVID-19 pandemic and the implementation of Stage 4 business restrictions across Victoria.

The implementation of these JobKeeper updates from 28 September will relax the requirements of the turnover test — entities will now need only meet quarterly decline in turnover testing for the previous quarter, rather than assessing multiple quarterly periods as per the previous JobKeeper rules.

Importantly, the employee eligibility test date will be changed from 1 March 2020 to 1 July 2020, as of Monday August 3rd 2020. This change to the reference date will be applied for the last four fortnights of the JobKeeper scheme, in addition to the duration of the extended JobKeeper Payment scheme period. This means that staff hired after March 1st, 2020, may now qualify for JobKeeper.

- The Treasurer’s announcement also details the predicted consequences of the new scheme, anticipating the following impact:

- The JobKeeper Payment scheme will now incur an additional $15.6 billion cost, with a revised total cost of $101.3 billion

- The scheme will be applied across Australia, with over 80 percent of the increased payments anticipated to be directed toward Victorian businesses impacted by Stage 4 business restrictions in the state

- Four million Australians are predicted to meet the eligibility requirements for the JobKeeper Payment scheme at the end of the September 2020 quarter, with this number falling to roughly 2.24 million by December 2020. By March 2021, the Australian Government predicts that 1.75 million Australians will be eligible for the scheme

The JobKeeper updates will be executed subsequent to the registration of a Legislative Instrument by the Treasurer in order to amend or supplement the current Legislative Instrument — the Coronavirus Economic Response Package (Payments and Benefits) Rules 2020 (the Rules).

The Treasury has published a simplified fact sheet detailing changes to the JobSeeker Payment, available via the Treasury website.

A three-month analysis of the JobKeeper scheme executed by the Treasury was published by the Treasury on July 21, 2021, providing findings via the JobKeeper Payment: Three Month Review available on the Treasury website. The review concludes that there is a “strong case” to continue the scheme beyond the original end date of 27 September 2020 and recommends a series of changes.

What Are the Current JobKeeper Rules?

- The existing rules governing the JobKeeper Payment scheme were announced on March 30, 2020. A detailed breakdown of the current JobKeeper rules and how they affect Australian businesses can be found via the Fullstack resources blog:

- Jobkeeper: How It Works

What Are the Changes to the JobKeeper Scheme?

- The following breakdown of the JobKeeper updates uses references to scheme periods and eligible individuals that will be clarified below:

- Current scheme: Refers to the currently enacted JobKeeper payment scheme from Monday 30 March 2020 to 27 September 2020

- JobKeeper 2.1: Refers to the proposed extended JobKeeper Scheme period from 28 September 2020 to Sunday March 2021

- Businesses or employers: Refers to businesses or employers that are eligible for JobKeeper, including not-for-profit entities and religious institutions that are also eligible for JobKeeper

- Employees or workers: Refers to employees, workers, business participants and religion practitioners that are eligible for JobKeeper

The JobKeeper updates are outlined below. All other unchanged features of the current scheme will remain the same throughout the duration of the extended JobKeeper Payment scheme.

Eligible Employees: Current Scheme Versus JobKeeper 2.1

In order to qualify as eligible for the JobKeeper scheme, an individual — or an eligible employee of an employer — must meet the following requirements:

Current Scheme

- An individual must be employed by an eligible entity at any time during a fortnightly period, including individuals that have stood down or been re-hired

- From March 1, 2020, the individual must be aged 18 years or older. Alternatively, the individual must be 16 or 17 years old from March 1 2020, independent, and not undertaking full-time study.

- From March 1, 2020, the individual must have been employed on a full-time, part-time, or fixed-term permanent basis, or employed as a casual long-term employee

- From March 1, 2020, the individual must be an Australian resident for social security law purposes. Alternatively, the individual may be a tax resident and hold a special category Subclass 444 visa

- The individual must agree to be nominated as an eligible employee by the employer

- The individual must not receive the Australian Government’s paid parental leave, dad and partner pay, or any worker’s compensation payments for total incapacity for work at any point during the fortnight period

- Business participants are subject to similar eligibility requirements, notably:

- From March 1, 2020, a business participant must be defined as a business participant in relation to the business

- From March 1, 2020, the business participant must be actively engaged in the business

Eligible Employees Under JobKeeper 2.1

The eligibility criteria for both employees and business participants will change from Monday 3 August 2020. Importantly, the reference date for employee eligibility for the extension periods will change from march 1, 2020, to July 1, 20202. This reference date change will also affect the final four fortnights of the current scheme.

- The new eligibility criteria for Employees under the JobKeeper updates are as follows:

- The individual has been employed by the business entity at any time during the fortnight, including individuals that have been re-hired or have stood down

- From July 1, 2020, the individual must be aged 18 years or older. Alternatively, the individual must be 16 or 17 years old from March 1 2020, independent, and not undertaking full-time study.

- From July 1, 2020, the individual must be employed on a full-time, part time, fixed-term permanent, or long-term casual employment basis

- From July 1, 2020, the individual must be an Australian resident for social security law purposes. Alternatively, the individual may be a tax resident and hold a special category Subclass 444 visa

- The individual must agree to be nominated as an eligible employee by the employer

- The individual must not receive the Australian Government’s paid parental leave, dad and partner pay, or any worker’s compensation payments for total incapacity for work at any point during the fortnight period

Payment Rates: Current Scheme Versus JobKeeper 2.1

Changes have been made to the way payments work under the new JobKeeper Payment scheme. Here’s what you need to know:

Current Scheme

Under the current JobKeeper Payment scheme, employers must pay eligible employees a minimum amount, which is paid by the ATO to the employee for each individual eligible employee. This minimum amount is currently $1,500 per fortnight, paid as a flat rate regardless of the work hours performed by an employee in the relevant fortnight.

Payment Rates Under JobKeeper 2.1

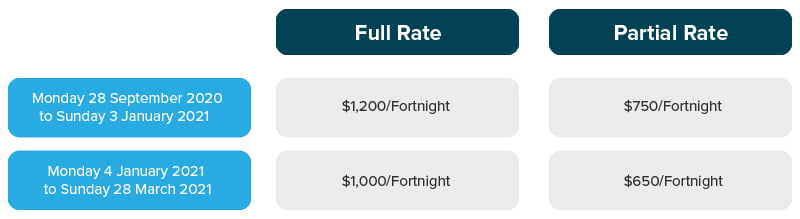

Under the new JobKeeper Payment scheme, payment rates will be reduced in two tranches as illustrated in the table below:

It’s important to note that businesses will be required to nominate the payment that they will claim.

Employee Categories & Hours Worked: Current Scheme Versus JobKeeper 2.1

The eligibility criteria for the full rate and partial rate outline above are specified below, under “Categories & Hours under JobKeeper 2.1”

Current Scheme

The current JobKeeper Payment scheme does not make any distinctions between full-time, part-time, casual, fixed term, or stood down employees when determining minimum payments. In the current scheme, every eligible employee is entitled to the minimum $1,500 payment — regardless of the number of hours they work within a specific fortnight period.

In order to be eligible for the JobKeeper Payment, an employee must have been employed by the business in a capacity other than casual — excluding long-term casual — by the business as of 1 March 2020.

Similarly, business participants must have been actively engaged with the business as of 1 March 2020.

Categories & Hours Under JobKeeper 2.1

The JobKeeper updates will divide payments into two tiers, which will be applied to employees based on their average weekly work hours within a relevant reference period. This reference period is defined as four weeks of pay periods — either as of 1 March 2020, or 1 July 2020.

Employees with eligibility defined by the March 1 period may use either period and select the one with the higher number of hours worked. The payment tiers are defined in the following table:

Under the current JobKeeper Payment scheme, there is no minimum number of hours that an employee or business participant must meet in order to qualify — employees and business participants must only have been employed by or actively engaged with a business on 1 March 2020.

Employees whose work hours decreased to less than 20 hours per week on average from at least 20 hours per work after either February 2020 or June 2020 will remain entitled to the full payment — including employees that were stood down. This eligibility is valid regardless of the hours the employee works in a fortnight from September 28, 2020.

Business participants who worked in their business for fewer than 20 hours per week on average before March or July 2020 but have subsequently increased active participation in the business due to the COVID-19 pandemic will not qualify for the full payment rate — regardless of how many hours they actively participate in their business from 28 September 2020.

Changes to Hours of Active Engagement for Business Participants

The first iteration of the updated JobKeeper Payment Scheme, published on July 21, 2020, indicated that the payment rate for business participants would be determined based on the amount of hours a business participant actively engages in the business — either over or under 20 hours — within February, 2020.

New updates to the proposed JobKeeper Payment Scheme remove all references to February 2020, and do not reference June 2020. The test period for business participants is likely to change in order to align with the test periods outlined for employees — the four weeks of pay periods leading up to either March 1, or July 1 2020. There is currently no specific guidance regarding specific testing practices for businesses that do not engage any employees and therefore have no pay periods in which to test.

Eligibility Criteria & Decline In Turnover: Current Scheme Versus JobKeeper 2.1

The proposed updates to the JobKeeper Payment scheme alter the way in which business turnover is measured.

Current Scheme

Under the current JobKeeper Payment scheme, the decline in business turnover is determined by comparing the projected GST turnover within a specific turnover test period in 2020 to the current GST turnover for its relevant comparison period 2019.

- The turnover test period can be assessed as either:

- A single calendar month from March 2020 to September 2020; or

- The June or September 2020 quarter

The comparison period must be the same month or quarter in 2019. Note that if the turnover test period is assessed as a quarter, the comparison period must also be a quarter, with the same rule applying for a single calendar month.

In order to qualify, a business must have experienced a decrease in turnover by a requisite percentage, such as 15, 30, or 50 percent. This decrease must be presented between the comparison period and the turnover test period.

The Commissioner exercises his discretion to establish alternative decline in turnover tests in any case in which an appropriate relevant comparison period is not available.

Decline in Turnover Test Under JobKeeper 2.1

The JobKeeper updates introduce new turnover test comparison period rules. The proposed new decline in turnover test is split into two extensions:

Extension 1 — 28 September 2020 to 3 January 2021 — will compare the actual GST turnover for the September 2020 quarter to the actual GST turnover for the September 2019 quarter.

Extension 2 — 4 January 2021 to 28 March 2021 — will compare the actual GST turnover for the December 2020 quarter to the actual GST turnover for the December 2019 quarter.

It’s important to note that this means from 28 September 2020 business will no longer be able to use projected GST turnover or to choose a calendar month as a test period in order to determine eligibility for the JobKeeper Payment scheme.

Businesses will be able to assess their eligibility based on details provided in their Business Activity Statement (BAS). September Business Activity Statements must be lodged by the late October deadline, while December BAS must be lodged in late January if lodging on a monthly basis, or in late February is lodging on a quarterly basis.

Businesses will therefore need to assess their eligibility for the JobKeeper Payment scheme in advance of the BAS deadline in order to meet wage condition requirements.

What Does the Commissioner’s Discretion Mean for JobKeeper 2.1?

- The Commissioner has discretion in relation to the ATO’s administration of the JobKeeper Payment scheme with regard to a number of matters, which include:

- The Commissioner has the discretion to establish alternative tests for the scenario in which an employee’s hours were not usual during the period between February 2020 and June 2020, such as employee leave, volunteering in emergency bushfire efforts, or not employed during the entire reference period

- The ATO will provide guidance in the case where an employee is not paid on a weekly or fortnightly basis

- The Commissioner has the discretion to extend the time period in which a business can meet wage conditions in order to provide businesses with the opportunity to confirm their eligibility for the JobKeeper Payment scheme

The ATO has not yet released any specific guidance regarding how the office will administer the proposed extended JobKeeper Payment Scheme.

Case Study: How the New JobKeeper System Works for Australian Businesses:

The following case study functions as an example of how the new JobKeeper Payment scheme will affect Australian businesses.

A business owner operates a cafe. The business owner began claiming the JobKeeper Payment for eligible staff members and themselves — as a business participant — when the JobKeeper Payment Scheme commenced on March 30, 2020.

At the time of claiming the JobKeeper Payment, the business owner estimated a 30 percent decline in GST turnover during April 2020, placing GST turnover for April 2020 at 70 percent of actual GST turnover in 2019.

In order to qualify as eligible for the JobKeeper Payment for the period of 30 March 2020 to 27 September 2020, the business owner must demonstrate that the turnover of the cafe business has declined by a minimum of 30 percent.

The business owner lodges Business Activity Statements on a monthly basis, and submitted BAS for the months of Joly, August, and September. The actual turnover for these months are presented in the following table:

The actual turnover decline for the September quarter, as outlined above, is 33 percent — as this decline is greater than 30 percent, the business is therefore eligible for the JobKeeper Payment for the period of 28 September 2020 to 3 January 20201.

Should business improve for the business presented in the example above and the actual turnover for the December 2020 quarter fall below 30 percent less than the December quarter 2019, the business would therefore no longer be eligible for the JobKeeper Payment Scheme for the second extension period beginning from 4 January 2021.

Determining Payment Rates

The business owner in the example above must determine exactly how much to claim for each staff member, and for the business owner themselves as a business participant.

Calculating Payment Rates for Business Participants

The business owner in case study above worked full-time at the business throughout February 2020. This allows the business owner to claim $1,200 per fortnight from 28 September 2020 to 3 January 2021, qualifying as an eligible business participant.

The business is also able to claim $1,200 per fortnight for each of the three full-time employees that worked 20 hours or more weekly throughout February 2020.

Calculating Payment Rates for Part-Time Employees

The business owner also employs one part-time employee, who works different hours every week. The part-time employee may work 14 hours one week, and 22 hours the next week. In order to determine whether this employee is eligible for full or partial JobKeeper Payments, it’s necessary to determine how many hours the employee works on a fortnightly basis.

If the part-time employee worked a total of 36 hours each of the two pay fortnights leading up to 1 March 2020, the part-time employee therefore worked less than 20 hours per week. The business owner is therefore eligible to claim $750 per fortnight for the part-time employee from 28 September 2020 to 3 January 2021.

Calculating Payment Rates for Long-Term Casual Employees

The business in the case study also maintains an employee who worked on a long-term casual basis between February and June 2020. In order to determine whether the long-term casual employee is eligible for partial or full JobKeeper Payments, the business owner must assess the pay records for the two fortnightly pay periods leading up to 1 March 2020 and 1 July 2020.

In this example, the long-term casual employee worked, on average, less than 20 hours per week, which allows the business owner to claim $750 per fortnight for the long-term casual employee from 28 September 2020 to 3 January 2021.

Calculating Payment Rates for New Employees

It’s also possible to claim JobSeeker Payments for new employees in specific conditions. The business in the case study employed a new part-time employee from June 2020. As the new part-time employee was employed at the business before July 1, 2020, the business owner can — in the same manner as calculating payment rates for long-term casual employees — refer to the pay records for the two fortnightly pay periods before 1 July 2020.

In this case, the new part-time employee averaged fewer than 20 working hours per week in the period leading up to July 1, allowing the business owner to claim $750 per fortnight for the new staff member from 28 September 2020 to 3 January 2021.

Key Takeaways

The proposed changes to the way JobKeeper Payment qualification works provides Australian businesses with new ways to support their employees through the COVID-19 pandemic, extending the duration of the JobKeeper Payment scheme and altering the way in which decline in turnover is tested.

Navigating the various eligibility requirements of the JobKeeper updates can be complicated. If you’re not sure whether you or your employees qualify for the JobKeeper Payment, reach out to Fullstack for comprehensive guidance today. You may also find these posts useful:

Was this article helpful?

Related Posts

- Small Business Tax Rate for 2020 & 2021

In this article we look at tax rates for small business in 2020 and 2021.Small…

- Small Business Grant

Been hiring recently? You’ll be pleased to note that the NSW government is keen to…

- Crypto Trading as a Business 101

Cryptocurrency trading as a business in Australia can deliver some impressive benefits. Do you qualify…

- Business insurance – balancing risk and price

All businesses face a variety of risks, and many risks can be mitigated through insurance.…