Cryptocurrency has gained significant popularity in Australia, with a growing number of individuals participating in the digital asset market.

However, as the industry continues to expand, it is crucial for investors to be aware of the potential risks associated with cryptocurrency investments. In response to recent events, the Australian government and regulatory bodies have taken steps to enhance legislation and protect customers. This article provides an overview of the cryptocurrency regulations in Australia, exploring its legal status, regulatory measures, and future plans.

Understanding the Current State of Cryptocurrency Regulations in Australia

According to research conducted by Roy Morgan’s Research Institute, approximately 5% of the Australian population, which amounts to over 1 million individuals, own cryptocurrency. However, surveys suggest that only a small percentage of cryptocurrency owners, around 20%, are aware of the risks involved in investing in digital assets. As the number of people involved in the industry continues to rise, it becomes increasingly important to educate investors about the potential vulnerabilities and pitfalls associated with cryptocurrencies.

Challenges Faced in the Crypto Market

The cryptocurrency market has always been susceptible to hacks, scams, and other fraudulent activities. Even trusted platforms and crypto investment businesses are not immune to collapse, leading to the loss of investors’ funds. Recent events in 2022, such as the FTX crypto exchange collapse, have highlighted the need for stricter regulations to protect customers and ensure market integrity.

Cryptocurrency Legality in Australia

Bitcoin (BTC) and other cryptocurrencies are legal in Australia and are recognized as property. Individuals can trade, spend, receive, and store cryptocurrencies, and they are accepted as a means of payment for personal and business transactions, although merchants are not obligated to accept them. Australia has fostered a neutral and stable market environment for blockchain and cryptocurrencies, encouraging innovation in payment systems, lending, investment, and custodial services.

Cryptocurrency and cryptocurrency exchanges achieved full legal status in 2017. Since then, Australian laws have embraced the innovation brought by technology, with minimal interference in the industry. However, in 2018, to combat money laundering and counter-terrorism financing, digital currencies were included in the Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regime under the Financing Act 2006.

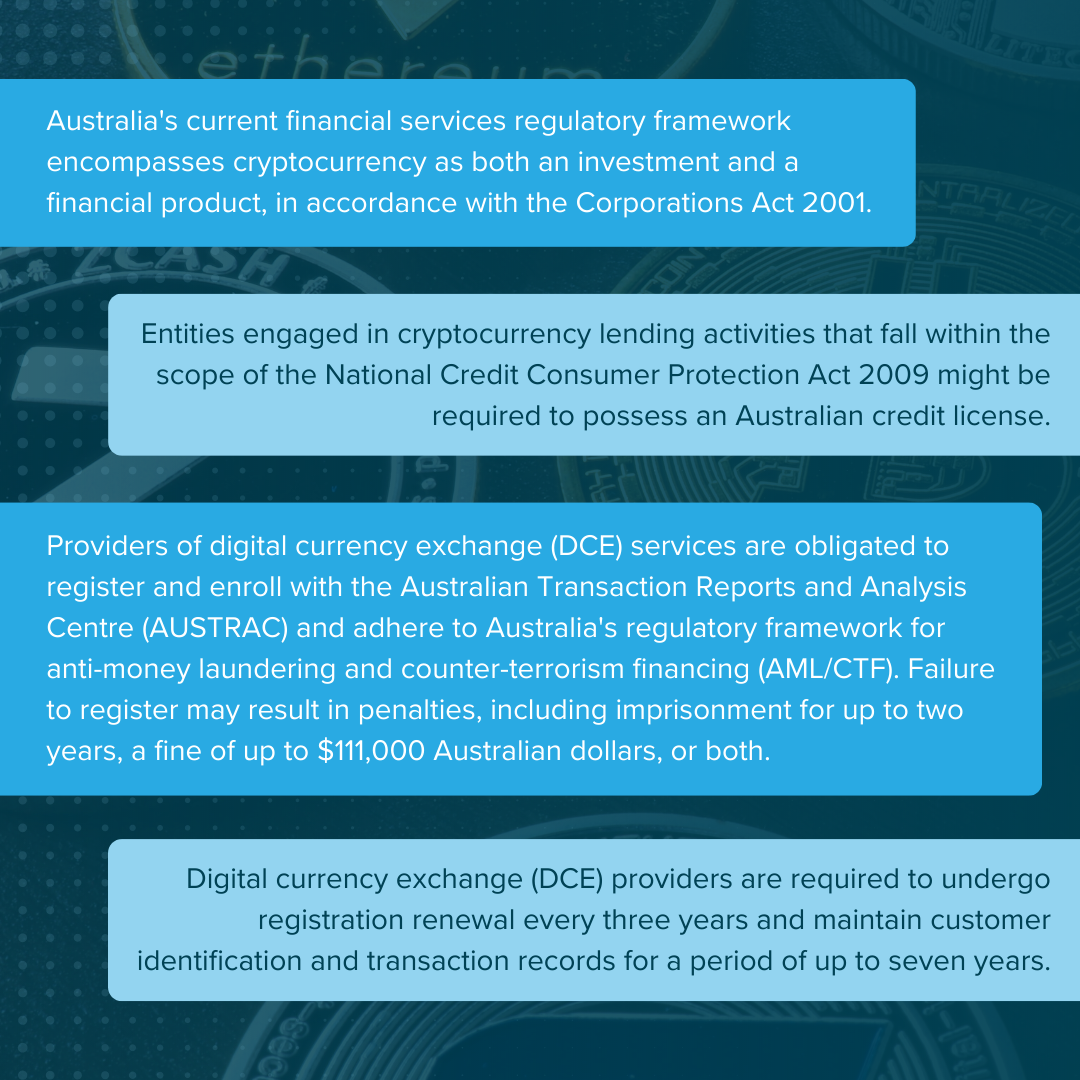

Regulatory Measures Implemented

The Australian government has historically taken a mild approach to regulating crypto assets. However, recent events have prompted calls for more effective regulations focused on consumer protection and market integrity. Although cryptocurrencies are not treated as a specific area of law, they can fall within existing regulatory frameworks under Australian law. Here are some instances:

Plans for Regulatory Framework

The Australian government has expressed its commitment to develop a comprehensive regulatory framework for the cryptocurrency sector. To achieve this, consultations will be initiated with industry players, investors, and stakeholders. The regulatory authorities aim to address significant gaps in the existing framework, determine custody obligations for third-party custodians, and establish additional consumer protection guidelines. The introduction of exchange regulations, custody arrangements, and Know Your Customer (KYC) processes are expected to safeguard customer funds.

Conclusion: Consult with Our Crypto Specialists for Expert Guidance

Navigating the evolving landscape of cryptocurrency regulations in Australia can be a complex task. To ensure compliance with the regulatory requirements and make informed decisions, it is crucial to consult with crypto specialists who possess in-depth knowledge of the industry, tax implications, and regulatory frameworks.

At Fullstack Advisory, we understand the intricacies of the cryptocurrency market and have extensive experience in helping individuals and businesses navigate regulatory challenges. Our team of experts can provide personalised guidance tailored to your specific needs and circumstances.

By consulting with our crypto specialists, you will benefit from:

- Expertise: Our specialists stay up to date with the latest developments in cryptocurrency regulations, ensuring that you receive accurate and timely information.

- Compliance: We will help you understand and fulfil your tax obligations, regulatory requirements, and reporting responsibilities, ensuring that you remain compliant.

- Strategic Guidance: Our specialists will assess your unique situation and provide strategic advice to optimise your cryptocurrency investments while minimising risks.

- Risk Management: We can assist you in implementing robust risk management practices, safeguarding your investments, and protecting your assets.

Do not navigate the cryptocurrency regulatory landscape alone. Consult with our experienced crypto specialists who can provide the guidance you need to make informed decisions and ensure regulatory compliance.

Was this article helpful?

Related Posts

- Tax Treatment of Cryptocurrency Exchanges in Australia

Crypto currency exchanges are critical to the crypto market ecosystem — but how are they…

- How is Crypto Taxed in Australia?

Whether you are a crypto trader or investor, you most likely have the task of…

- Cryptocurrency Tax: Avoid 5 Most Common Mistakes

Tax time can be stressful for crypto traders, especially for DIY crypto tax reporting. In…

- Cryptocurrency Mining Taxes

If you're currently mining crypto, it's important to learn how cryptocurrency mining is taxed. This…