To get your business in top shape, we recommending reviewing these accounting reports on at least a monthly basis and aligning the results with your financial strategy.

Financial reports are essentially the dashboards showing how your business is tracking money-wise. The best founders use these to track their performance towards their financial targets and make smart decisions around where & when to spend or earn their money next.

No matter how big or small your business is, whether you do your own bookkeeping or you have an entire accounting team, there are three reports that all entrepreneurs must know like the back of their hands.

We cover the main go-to reports below:

Balance Sheet

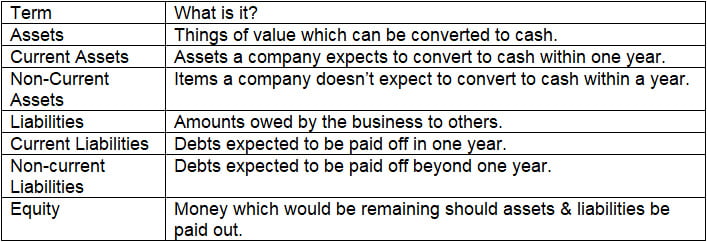

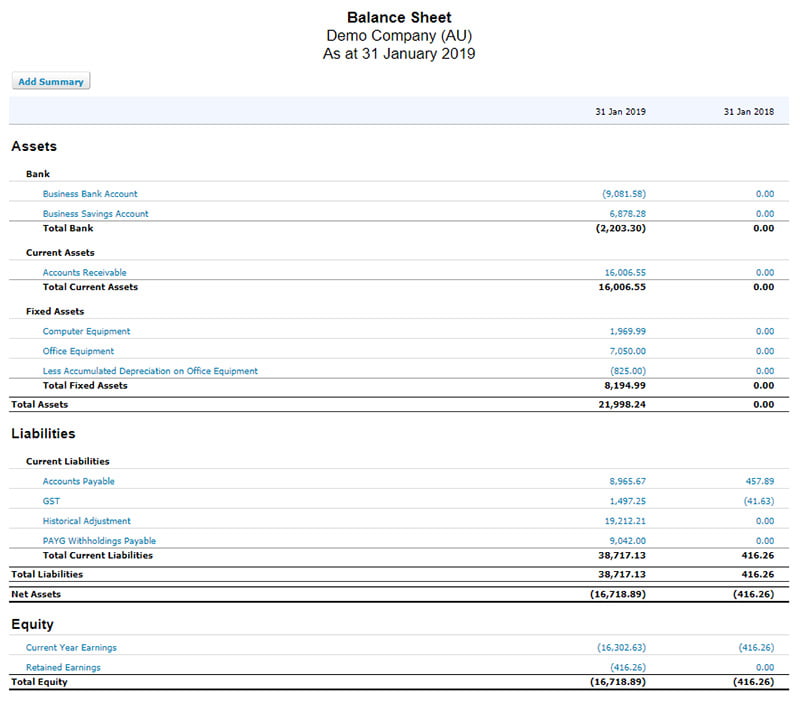

Of the big three accounting reports, the balance sheet is the only one that shows the financial health of a company at a given moment. Instead of listing your business’s income and expenses like the P&L does, the balance sheet essentially provides a snapshot for assets, liabilities & equity held by the company.

Some of the terms you’ll come across are explained below.

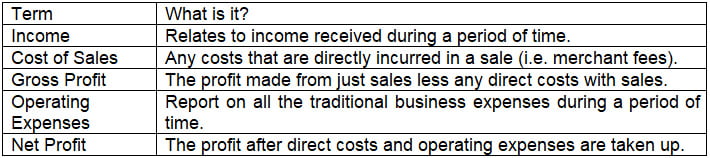

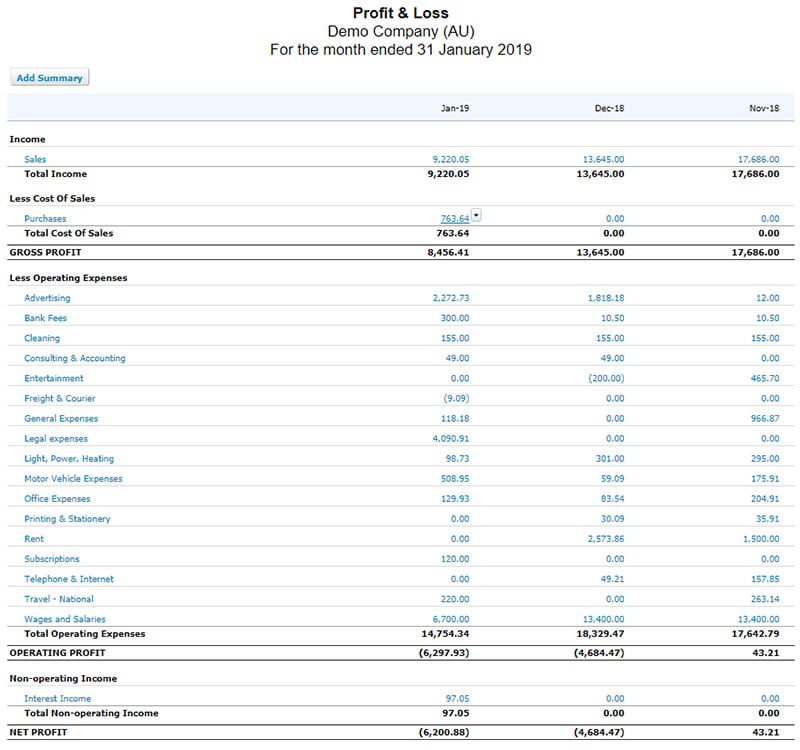

Profit & Loss

This report shows how much revenue & expenses a company earned over a period of time.

The P&L is the best view into your bottom line, or net income, which is why it’s typically used to show business lenders and investors whether your company has made or lost money during a given period.

Your business’ net profit is also what will be used to determine its taxable income each year.

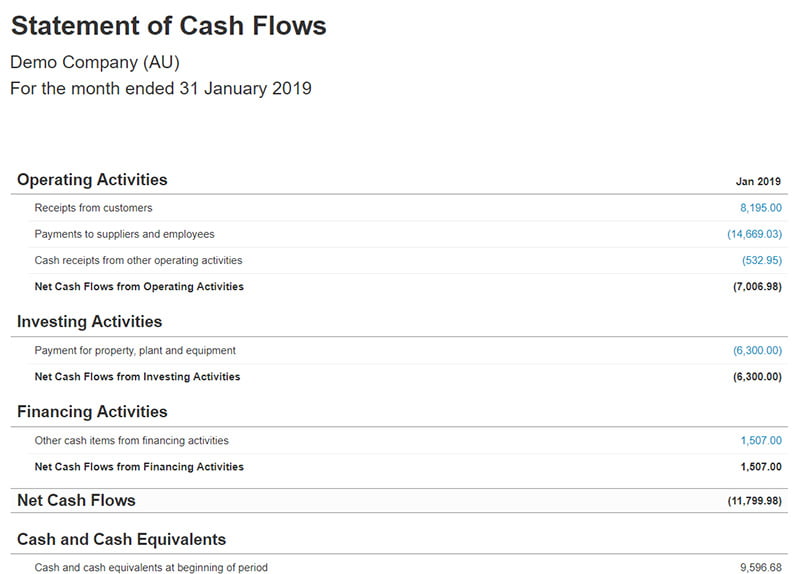

cash flow Statement

Your cash flow statement shows the results of your business cash income and outgoings over a period of time. The cash flow statement combines the P&L and also takes any non-cash transactions into account from operations, investing or financing activities to give you a picture of exactly what happened to company’s cash balance during that period.

So, if a company gets $1M in capital, but their P&L shows a net income loss of $50k during the same period, their cash flow statement will show a $950k net increase in cash for that period.

Because your cash flow statement provides a more comprehensive view of how your business operates with its cash, its more often a report of choice by an advisory board.

To get your business in top shape, we recommend reviewing these reports on at least a monthly basis and aligning the results with your financial strategy.

If you need accounting assistance in producing investor ready reports please reach out to our team.

Was this article helpful?

Related Posts

- Cloud Accounting - Which Accounting Platform

We've done the hard yards in trialing out the cloud accounting solutions so you don’t…

- Understanding your accounting obligations - BAS's, Tax Returns, PAYG, Receipts and More

Keep your business onside with compliance by filing your accounting obligations on time and in…

- Startup Accounting Policies

Startups often have unique business models which can raise difficult questions about the most appropriate…

- Advisory Boards for Startups

As a startup you will often hear about the need for an Advisory Board, but…

- Reporting to a Board of Directors

A properly structured and functioning Board of Directors contributes significantly to the success of a…