When you apply for an ABN, it should be a straightforward process — but it can quickly become confusing to beginners. Fullstack examines the whole ABN application process so you can go through it painlessly.

If you are planning to do business in Australia, you will definitely need an ABN (Australian Business Number). Business owners are required by law to register with the Australian Tax Office (ATO). The ABN empowers the ATO to keep track of all business transactions in Australia for tax purposes.

To save you from all the pain of doing it alone for the first time, we’ll take a look at how ABN registration works, ABN eligibility requirements, and the ABN application process, as well as answering some more complicated ABN questions along the way.

What is ABN?

An ABN is an 11-digit number that is used to identify businesses in Australia, regardless of their size or industry. Foreign enterprises in Australia are also identified using ABNs — whether they operate an enterprise, or simply make sales connections within Australia.

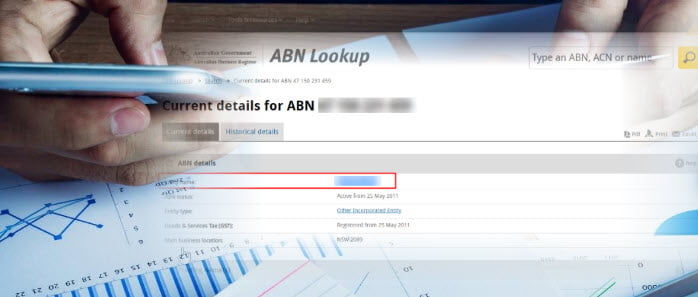

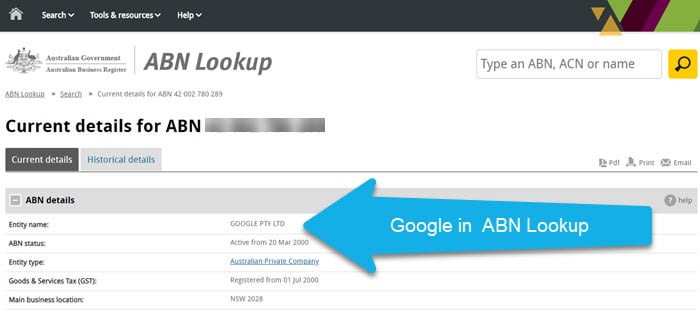

The Australian Business Register (ABR) records all ABN applications. For transparency, the public can also look up some of the details you used to register for an ABN.

Each Australian business entity legally entitles it to a single ABN. However, if one business owner is running several businesses, like a laundry shop, a coffee shop, and an accounting firm, then he or she can use the same 11-digit ABN for all three shops. The laundry shop, coffee shop, and accounting firm are considered the same entity as all these businesses have one owner.

Do I need an ABN?

Technically, if you are running your own business, it is compulsory to get an ABN. You’ll need an ABN if you are carrying out a business operation or enterprise, and not working for somebody else. However, applying for an ABN is an entirely different process from registering a business name.

Most businesses generate income, which means you will need to register a Tax File Number or TFN if you don’t already have one. A complete ABN registration is compulsory before applying for pay-as-you-go (PAYG) or goods and services tax (GST). Our Understanding Your Accounting Obligations article explains all the tax obligations of businesses in detail.

ABN Eligibility Requirements

The ATO provides detailed guidance on ABN eligibility via the Australian Business Register website. You are entitled to an ABN if you are operating a business, rather than a hobby, and you’re not carrying out business tasks for anybody else.

The line between a hobby and a business can be challenging to define. The ATO provides easy to understand information on the definition of a business. Essentially, if you are treating an operation as a business and managing it in a businesslike manner with the intent of generating income, you’re in business.

Am I eligible for an ABN?

Yes, if you:

- Operate a business or enterprise

- Provide evidence that you have a business structure

How to Apply for an ABN

There is no cost involved with registering an ABN. To apply for an ABN, fill out the online ABN application. The ABN registration process involves a series of questions that determine ABN eligibility. In addition to answering eligibility questions, you’ll also need to provide identity information.

How do I apply for an ABN?

- To apply for an ABN online, you’ll need to provide the following details:

- Business name or trading name

- Your legal name

- Your postal address and business address

- The type of business you operate: sole trader, company, partnership, etc

- Contact details

- Business function, including the industry of the business

- Email address

Online ABN registrations are completed immediately, with ABNs often issued instantly after a successful registration. The ABR website will publish your ABN details after registration. A paper confirmation will follow within 14 days of registration.

If your registration fails, you will receive a letter of refusal within 14 days. In some cases, ABN registration can fail due to incorrect or inaccurate identity information. The review process for failed registration typically takes 20 business days.

Do foreign businesses need to apply for an ABN?

You don’t have to be an Australian resident to apply for an ABN. If you are a non-resident, you’ll still need to register an ABN if you perform business activities in Australia.

Does my foreign business need an ABN?

- You’ll need an ABN if you:

- Operate a business or enterprise in Australia

- Make sales in Australia

In short, non-residents applying for ABNs must provide identity information, Australian TFN details (if available), and a statement of business activities within Australia.

Do Sole Traders need an ABN for a Company?

Companies must apply for a separate ABN. If you’re currently operating as a sole trader and are changing your operation to a company structure, you need to cancel your old sole trader ABN.

Unfortunately, it’s not possible to transfer a sole trader ABN into a company. For a company to register an ABN, all company directors must provide identity information.

The process to undergo when you apply for an ABN is quick and convenient. To avoid unnecessary delays, you must ensure all your entries in the ABN form is correct and truthful. Remember, ABN is a compulsory requirement to do business in Australia, and getting it is a top priority in moving forward to achieve your startup goals.

If you operate a business in Australia, you’ll likely need an ABN. It’s also essential to cancel your ABN if your business closes or is no longer working. If you have any questions about your ABN or assistance with setting up your business structure, feel free to get in touch with Fullstack today.

Was this article helpful?

Related Posts

- Tax Treatment of Cryptocurrency Exchanges in Australia

Crypto currency exchanges are critical to the crypto market ecosystem — but how are they…

- What's the Difference Between ABN and ACN?

Every business in Australia needs an ABN — but not every business needs an ACN.…

- How is Crypto Taxed in Australia?

Whether you are a crypto trader or investor, you most likely have the task of…

- Preparing for EOFY – The Small Business Tax Checklist

EOFY is coming. Have you prepared your business in terms of tax planning? Here’s some…